Penny sales tax for education discussed on the November ballot

State Question 779 proposes a one percent increase in sales taxes to combat education budget cuts

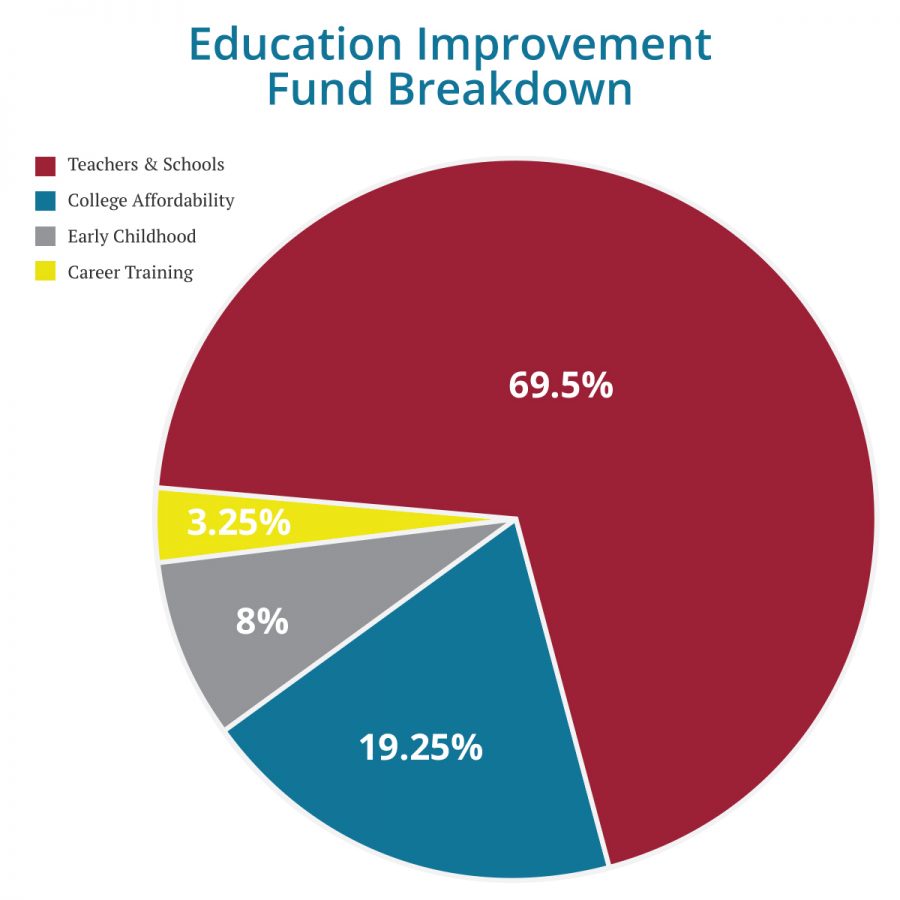

The penny sales tax increase hopes to increase funding in four areas. Photo courtesy of yesfor779.org

September 20, 2016

It is no secret the state of Oklahoma has seen drastic changes this year with education funding. With many schools having to deal with large budget cuts, there has been a new proposal that hopes to help this problem.

State Question 779, known as “The Oklahoma One Percent Sales Tax” is on the ballot for November 8, 2016. If this passes the state’s sales tax will increase by one percent.

This extra funding is said to go to teacher’s salaries, higher education, grants, early childhood programs and vocation and technology education. Oklahoma’s teachers have not been given across the board raises in eight years.

That doesn’t seem right considering teachers are the ones that will educate the generations to come. They will educate our future generations and form them into what our society needs.

According to the Oklahoma Education Association, if voted “yes” this will bring an estimated $615 million to the state’s education departments.

While many people agree our school systems need more funding, it seems many think there are other ways that could be more beneficial. This may seem to help the education funding problems, but it is likely to cause financial problems in other areas of our state.

According to data from a national research group, if State Question779 is passed, Oklahoma will be the state with the highest combined state and local taxes.

In less than two months the fate of “The Oklahoma One Percent Sales Tax,” will be brought to the table. November 8, 2016 will determine the taxes of Oklahoma.